Vignesh

1 year ago

admin

#price-prediction

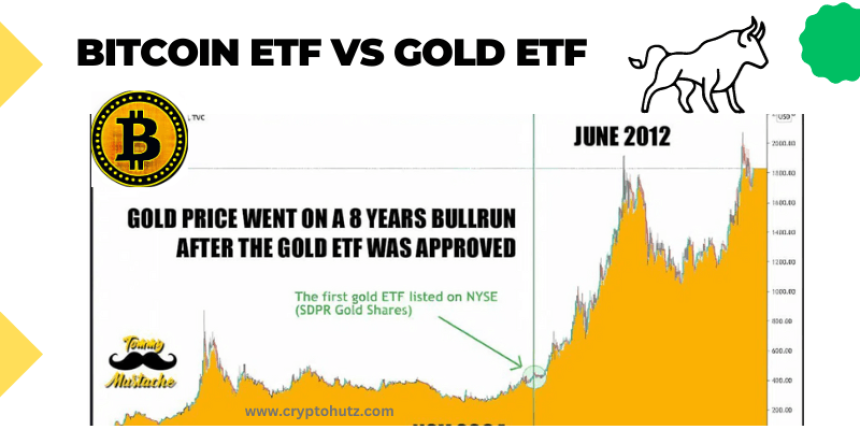

Will Bitcoin ETF repeat the same as Gold ETF

Uncover the potential market-shifting implications as we draw parallels between the significant impact of Gold ETFs on markets and the potential influence of a spot Bitcoin ETF

Understanding Spot Bitcoin ETFs

- Spot Bitcoin ETFs provide everyday investors with exposure to Bitcoin's price movements within regular brokerage accounts.

- Unlike Bitcoin futures ETFs, spot Bitcoin ETFs directly invest in bitcoins as the underlying asset, rather than derivatives contracts.

The Road Ahead: Navigating the Future of Spot Bitcoin ETFs

- Regulatory Status: As of October 2023, regulators had not approved a spot Bitcoin ETF, with the SEC expressing concerns about market manipulation, fraud, custody, and investor protection.

- Challenges and Opportunities: The evolving regulatory landscape in the United States and its potential impact on spot Bitcoin ETFs becoming a standard for cryptocurrency investments, especially for institutional investors.

Unlocking the Future: Introducing Bitcoin ETF Token

- Anticipation for Bitcoin ETFs: A Bitcoin exchange-traded fund (ETF) has been a long-desired development in the cryptocurrency world, with BlackRock's official application marking a significant step forward.

- Spot ETF Influx: The imminent arrival of spot ETFs is anticipated to inject billions or potentially trillions of dollars into the crypto market, amplifying its financial landscape.

- Secure Your Position: Stay ahead of the curve by acquiring Bitcoin ETF Token, a cryptocurrency linked to Bitcoin's fate and the awaited ETF approvals from the SEC.

0x3c87AAff27f1085B67cd742302939a50E2F2d406 - BTCETF Token

Countdown to Approval: Final Deadline Nears for Spot Bitcoin ETF Applications

- Closing Window: The deadline for fund managers to solidify their applications for a spot Bitcoin ETF in the U.S. is imminent, set for Friday, December 29.

- Key Players: Notable contenders such as BlackRock, VanEck, Ark Investments, Fidelity, and Grayscale are among the dozen fund managers racing to launch a spot Bitcoin ETF.

- Approval Wave: Applications must be completed by the specified date to stand a chance at being included in the initial wave of spot Bitcoin ETFs expected to gain approval from the SEC.

- Regulatory Guidance: Issuers have been cautioned to avoid any mention of in-kind creation in their applications, as the SEC emphasizes the preference for cash creation and redemption to mitigate security risks.

- Negotiation Highlights: The ongoing deliberations between ETF issuers and the regulatory body on creation and redemption methods have been a focal point, with a shift towards cash transactions to address cryptocurrency transfer concerns.

Spot ETF Approval for Bitcoin in 2024: Anticipating Impact on Prices and Markets

- Anticipated Approvals: Analysts, including those at Bloomberg, foresee a high likelihood (90%) of the U.S. SEC granting approval for spot Bitcoin Exchange-Traded Funds (ETFs) in January 2024.

- BlackRock's Move: BlackRock's amended filing on December 22, allocating a $10 million seed fund for its spot Bitcoin ETF, is seen as a strategic move that could influence the SEC's decision in early January.

- Market Dynamics: A spot Bitcoin ETF approval is expected to reshape the relationship between the crypto market and traditional financial institutions, opening doors for institutional investors.

- Market Efficiency: Increased institutional participation is likely to lead to higher trading volumes, enhanced liquidity, and a more efficient market, with tighter spreads.

- New Financial Products: The approval could pave the way for the development of new financial products and services backed by Bitcoin, tailored to meet the needs of institutional investors.

- Financial Inflow Estimates: Analyst Nicholas Sciberras suggests the approval could bring in a substantial influx of capital, ranging from $30 billion to $300 billion into Bitcoin.

- Unlocking Wealth: Grayscale CEO Michael Sonnenshein notes that a spot ETF approval would allow financial advisors to include BTC in portfolios, potentially unlocking around $30 trillion in advised wealth.

- Impact on Exchanges: The approval might pose challenges for cryptocurrency exchanges, leading to increased competition as investors shift from traditional exchanges to ETFs.

- Market Predictions: Speculations on BTC's price post-approval vary, with Blockstream's Adam Back suggesting a potential skyrocket to $1,000,000, while analyst Anthony Scaramucci offers a more conservative estimate of $330,000.